Bitcoin To Surge To $130,000 Next? What The Wave Count Says

After a week of volatile price action, Bitcoin has once again returned to familiar territory around the $106,000 price level. However, on-chain data shows that investors are still cautious, with the crypto Fear & Greed Index now in the neutral zone.

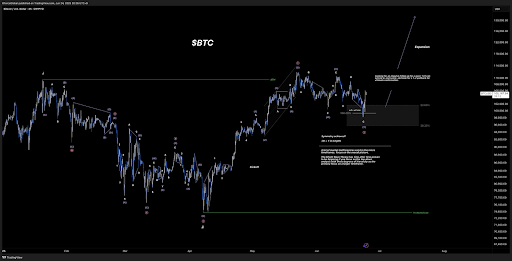

On the other hand, technical analysis of Bitcoin’s price action on the 4-hour candlestick timeframe chart shows that its price behavior has completed a significant correction, one that’s paving the way for a major rally to $130,000.

Bitcoin’s Wave 2 Correction Might Be Complete

According to XForceGlobal, a crypto analyst who posted a detailed Elliott Wave chart on the social platform X, Bitcoin’s recent correction fits neatly within a completed WXY pattern. The second wave, which started following the all-time high of $111,814 on May 22 and formed the corrective structure, has now retraced into the expected Fibonacci range between the 23.6% and 38.2% levels. Notably, the ideal minimum target for this correction move was in the $90,000 region, and Bitcoin fulfilled that condition with the pullback to just under $98,200 over the weekend.

The most important thing was in preserving the macro wave structure. Instead of drawing out a deeper pullback into the 0.618 to 0.886 Fibonacci levels, which is often characteristic of bear market retracements, the analysis maintains the idea that this was a wave 2 correction within a larger bullish impulse.

This distinction is important. If the WXY correction is indeed complete and wave 2 has concluded, the next logical move in the Elliott Wave sequence is a third wave advance. According to Elliott Wave analysis, the third wave is often the most explosive in terms of price expansion. Its outcome could therefore push the price of Bitcoin to new heights that are significantly higher than its most recent all-time high.

Why $130,000 Is A Realistic Target For Bitcoin

The analyst’s technical projection on Bitcoin’s 4-hour candlestick timeframe chart shows an expected wave 3 trajectory extending beyond $111,800 , with an expansion arrow reaching up above $130,000. This is the expansion move and is based on a similar projection of Wave 1.

In the accompanying chart, the analyst marks the key pivot zone between $98,000 and $102,000 as the Wave C termination area. If this zone indeed marks the completion of the second wave, the next movement would require validation through the formation of a clear 1-2 structure within Wave 3.

This means that confirmation of the bullish count also depends on the price making a new local high above the current range and then pulling back without breaching the recent lows. If that structure plays out, then the market would likely be in the early stages of a powerful third wave.

Bitcoin has already made an 8% price gain after it dropped to a low of $98,200 following U.S. airstrikes on Iranian nuclear sites. The most significant upward move came on Tuesday, June 24, when reports of a Middle East cease-fire pushed Bitcoin up roughly 4%. At the time of writing, Bitcoin is trading at $106,330.

$179,000 Or $79,000? Bitcoin Faces Critical Cycle Pivot, Says Analyst

A popular crypto analyst has issued a stark cyclical warning that could define Bitcoin’s trajectory ...

Crypto ETF Race Heats Up, More Solana ETFs Planned as Snorter Bot Corners Market for Solana Memes

The SEC’s filing cabinet has to be pretty full these days, and their ‘paperwork pending’ stack is ge...

XRP Bulls On Alert—’This Trendline Is Everything,’ Says Analyst

XRP spent the past forty-eight hours coiling into a textbook inflection zone, and the 15-minute char...