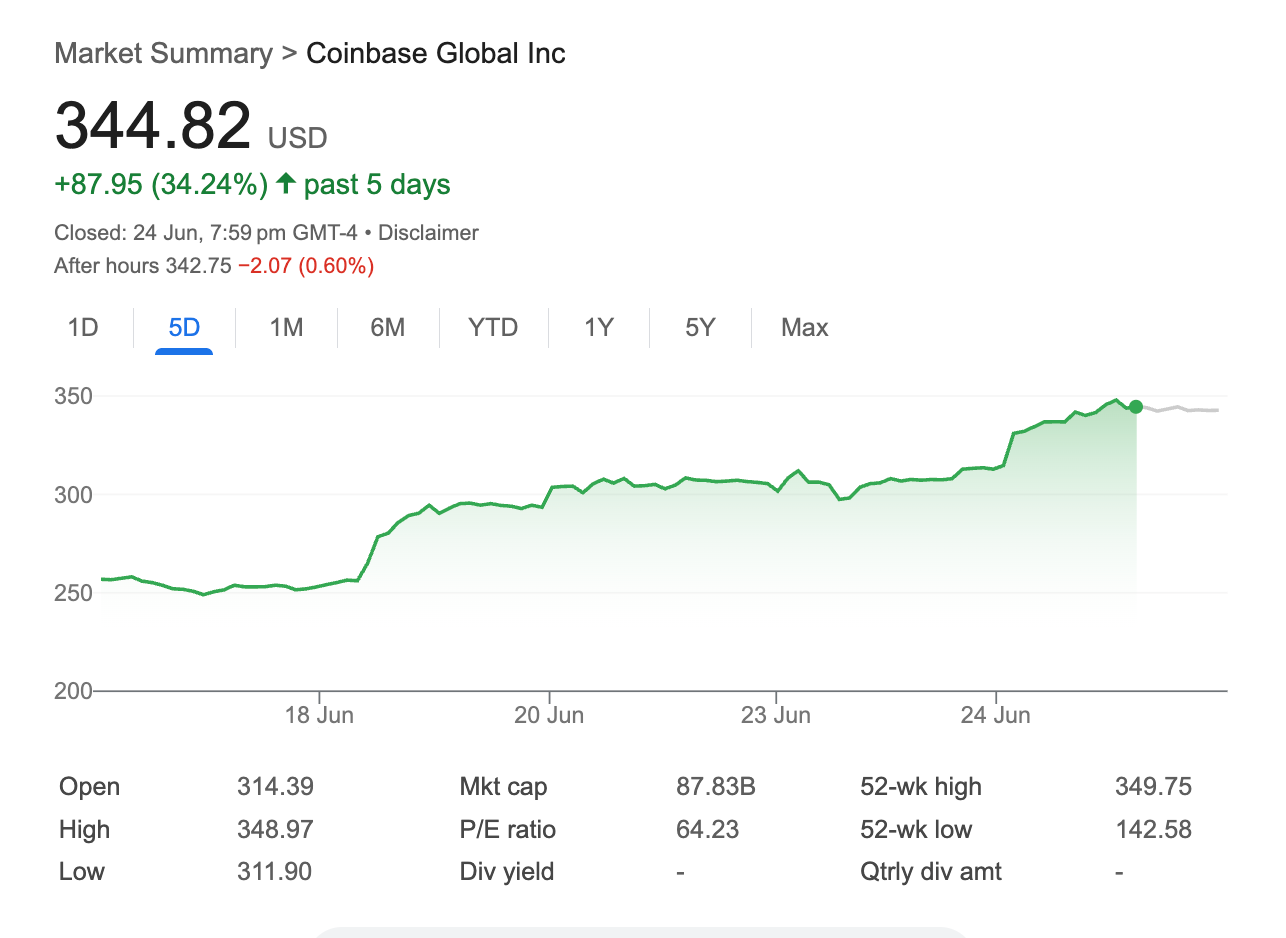

Coinbase Stock Rockets 12% on MiCA Approval, Regulatory Tailwinds

Coinbase Global Inc. (COIN) emerged as the top performer in the S&P 500 on Tuesday, climbing 12% to close at $344.94 - marking its strongest level in over six months.

The cryptocurrency exchange's rally caps off a remarkable five-day run that has seen shares gain approximately 33%, reversing months of subdued performance and positioning the stock for potential further gains as regulatory clarity improves across key markets.

Stablecoin Legislation Drives Market Optimism

A significant catalyst for Tuesday's surge was the continued momentum from the Senate's passage of the GENIUS Act, landmark legislation that establishes a comprehensive framework for stablecoin regulation in the United States. The bill's approval has been viewed as a watershed moment for the cryptocurrency industry, potentially opening new avenues for institutional adoption and mainstream integration of digital assets.

The legislation specifically benefits Coinbase's business model, as the exchange stands to gain from increased stablecoin trading volume and clearer regulatory guidelines that could attract more institutional clients to its platform.

Coinbase's rally occurred alongside strength in other cryptocurrency-related stocks, including Robinhood Markets, which also trades higher on renewed investor interest in digital asset exposure. The sector-wide momentum suggests that regulatory clarity and improving market conditions are beginning to attract broader institutional and retail investor interest.

European Expansion Gets Major Boost

Adding to the positive sentiment, Coinbase achieved a significant regulatory milestone by securing a Markets in Crypto-Assets (MiCA) license from Luxembourg's financial authority. The approval makes Coinbase the first major U.S.-based cryptocurrency exchange to receive authorization under the European Union's comprehensive digital asset regulatory framework.

This regulatory green light, announced June 20, grants Coinbase legal permission to offer its full suite of services across all 27 EU member states, representing a major expansion opportunity in one of the world's largest financial markets. The MiCA license is expected to significantly boost Coinbase's international revenue potential and provide a competitive advantage over rivals still seeking European regulatory approval.

The broader cryptocurrency market's recovery also contributed to Coinbase's strong performance. Bitcoin rebounded strongly above $106,000 after weekend volatility.

Institutional Interest Grows

Professional investment interest in Coinbase continues to build, with Cathie Wood's ARK Invest funds adding nearly 4,200 shares to their holdings on Monday. The purchases signal continued institutional confidence in Coinbase's long-term prospects despite the volatility typically associated with cryptocurrency markets.

Additionally, Wall Street analysts have been raising their outlook for the stock, with Benchmark recently increasing its price target to $421 from $301, reflecting growing optimism about the company's fundamental prospects.

Powell Gives the Nod to Stablecoin Bill

Fed Chair backs stablecoin legislation and ends "reputational risk" barriers for crypto-friendly ban...

ETH Climbs on SharpLink Purchase, Geopolitical Relief

Gaming company's latest purchase brings total ETH holdings to 188,478 tokens amid improving geopolit...

Mastercard Expands Further Into Crypto

Mastercard's partnership with Chainlink signals a powerful convergence of traditional finance and We...