Crypto Bears Rekt: $359M Gone As Bitcoin, Ethereum Rebound

Data shows the rebound in Bitcoin and other cryptocurrencies has punished the bears, triggering a massive wave of short liquidations.

Crypto Sector Has Just Witnessed A Mass Liquidation Event

According to data from CoinGlass , a large amount of liquidations have piled up on the cryptocurrency derivatives market. “ Liquidation ” refers to the forceful shutdown that any open contract has to go through if its losses exceed the threshold defined by its platform.

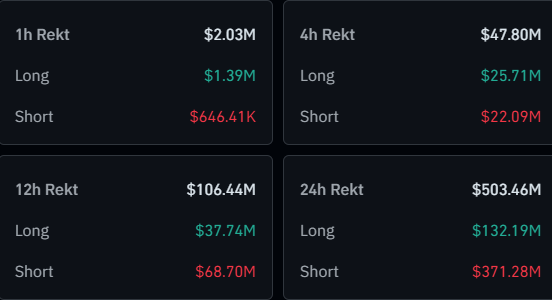

Below is a table that shows the numbers related to the latest liquidations in the market.

As displayed, the cryptocurrency sector has seen a derivatives flush of over half a billion dollars during the past day. Out of these, 73.7% of the liquidations, equivalent to $371 million, came from the short investors alone.

The short-heavy mass liquidations have come as Bitcoin and company have rebounded following the news of a ceasefire between Israel and Iran. Earlier, US strikes on Iranian nuclear facilities had induced a crash in the market that ended up unleashing a flurry of long liquidations. This time, it seems the bears have been the ones caught out instead.

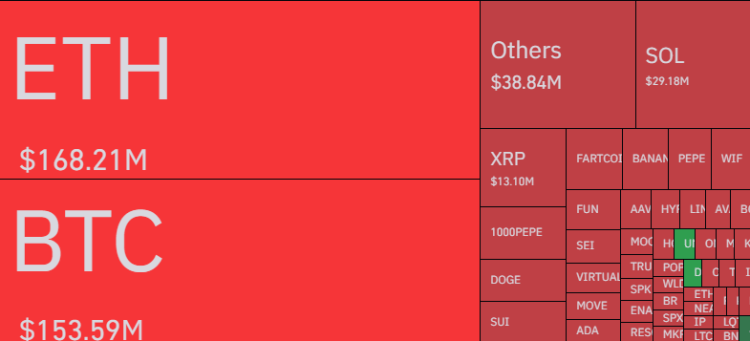

As usual, Bitcoin and Ethereum have topped the list of liquidations, but interestingly, the latter ($168 million) has managed to outweigh the former ($153 million), which is generally not the case.

Ethereum observing a higher amount of liquidations could come down to the fact that its price has seen a larger jump during the past day (7% vs 3.5%). It could also be an indication of an elevated level of speculative interest in the cryptocurrency.

Out of the altcoins, Solana and XRP have topped the charts with $29 million and $13 million in liquidations, respectively. Though clearly, these numbers are quite small compared to the figures of the top two titans, showcasing the sheer difference in capital involved.

In some other news, Bitcoin taker buy volume has shot up on the cryptocurrency exchange Bybit, as an analyst has pointed out in a CryptoQuant Quicktake post .

In the chart, the data of the Bitcoin Taker Buy Sell Ratio is shown. This metric measures the ratio between the taker buy and taker sell volumes for a given platform. Here, the exchange involved is Bybit.

It would appear that the indicator has recently seen a sharp spike above the 1 mark, a sign that long volume has started to sharply outpace the short one. According to the quant, spikes in the metric on Bybit have often preceded a surge in the BTC price.

BTC Price

Following the recovery run over the last 24 hours, Bitcoin has returned to the $105,100 mark.

Stablecoins Approach $250 Billion, Anchoring 8% Of Global Crypto

Based on reports, stablecoin issuance has kept climbing for the past 90 days, with billions of dolla...

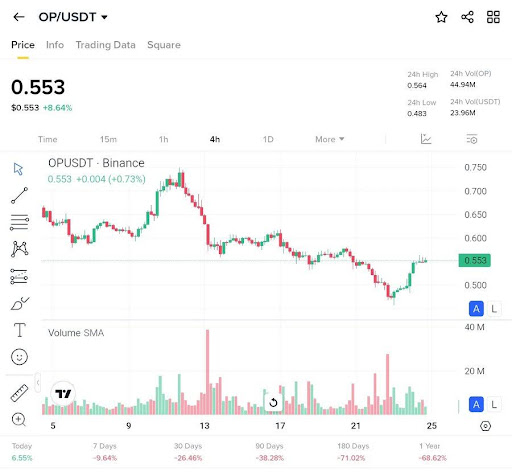

Optimism Flickers At $0.553: A Recovery Or A Pause The Decline?

Crypto Man MAB, in his latest analysis on X, pointed out that Optimism (OP) is now priced at $0.553,...

GoldenMining Investors Earn Average Profit of $9,800 on Bitcoin Surge Day Stable Daily Income Model Attracts Thousands to Join Global Cloud Mining Platform

As geopolitical developments continue to impact global markets, the cryptocurrency space remains hig...