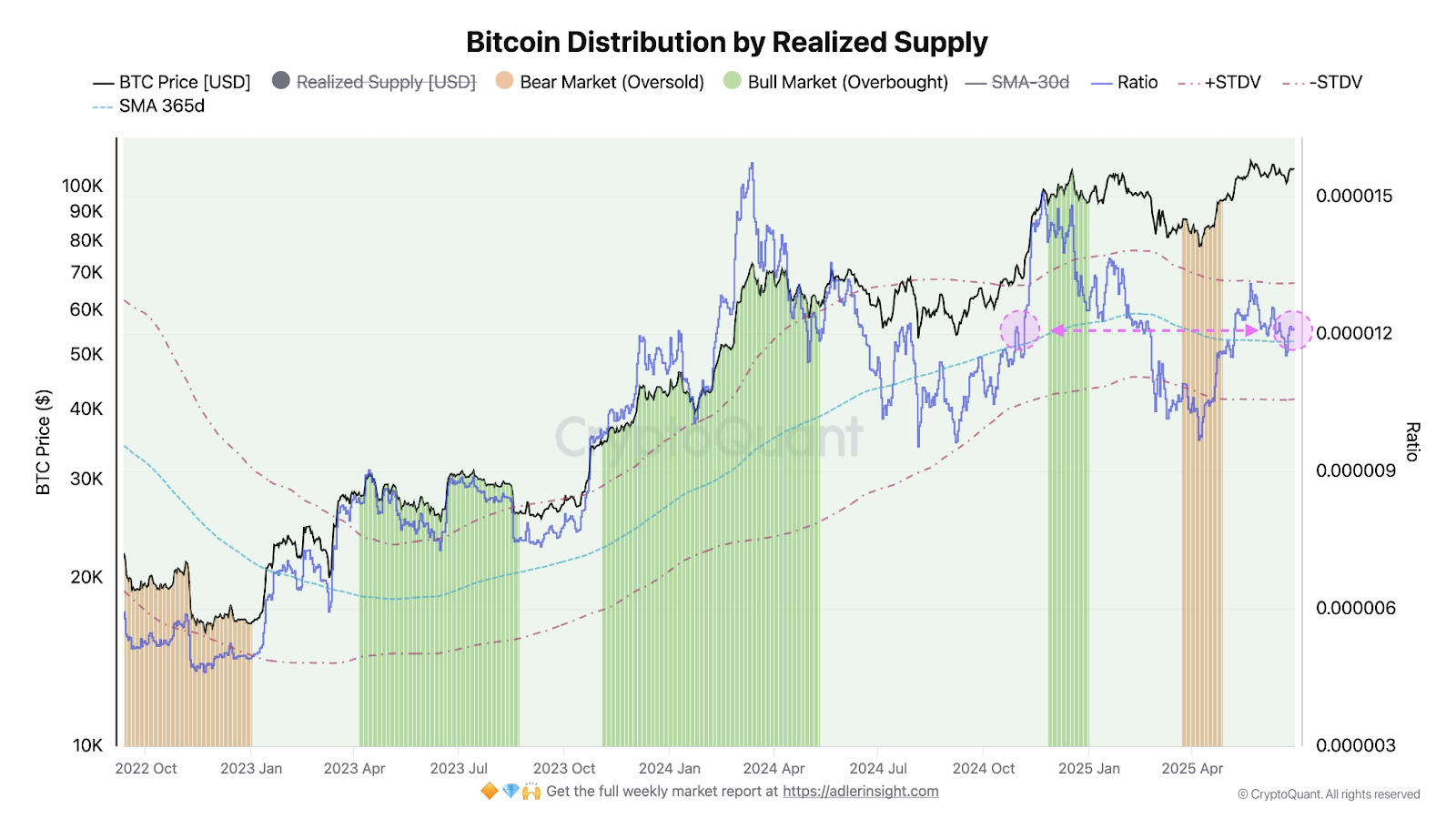

Bitcoin Market Holds Steady Near $107,000 as Realized Supply Signals Neutral Valuation

- Bitcoin price holds steady above $107K amid rising trading volume and stable market conditions.

- Realized Supply ratio indicates Bitcoin is neither overbought nor oversold, showing market balance.

- Market cap hits $2.14T with strong liquidity as price and realized supply converge near historical levels.

According to recent market metrics analyzed through the Realized Supply valuation model, Bitcoin’s price is holding firm above $107,000 amid rising trading activity. This metric shows insight into Bitcoin’s relative cost by comparing the current price against the historical dollar value at which holders last moved their coins. Recent data points suggest Bitcoin’s valuation is balanced, neither overbought nor oversold, indicating a consolidation phase in the market.

Realized Supply measures the aggregate cost basis of all Bitcoin in circulation by calculating each coin’s value at its last movement on the blockchain. By comparing Bitcoin’s spot price to this realized supply, the ratio yields a valuation similar to the price-to-earnings ratio used in traditional stock markets. A higher ratio can point to an overbought market, while a lower ratio indicates potential undervaluation.

From late 2022 through mid-2025, Bitcoin’s market cycles reflected by this metric show clear periods of bullish and bearish sentiment. The bear market phase in late 2022 and early 2023 saw prices trading between $15,000 and $20,000, with realized supply exceeding the market price, signaling oversold conditions.

This was followed by an extended bull run through 2023 into 2024, with Bitcoin rising to nearly $100,000 by late 2024. During this time, realized supply trended below the market price, illustrating strong investor confidence.

Source: X

Entering 2025, Bitcoin experienced a brief bear phase before moving into a smaller bull market. The latest figures indicate that the price and realized supply converged around the $60,000 to $70,000 range before a renewed stabilization above $107,000, suggesting market equilibrium.

Current Market Snapshot: Price, Volume, and Capitalization

As of press time, Bitcoin’s price was trading at $107,651.16, marking a 0.25% gain in the past 24 hours. Intraday trading reflected some volatility, with prices fluctuating between $107,360 and peaks above $108,700. Despite the price changes, Bitcoin maintains its dominance with a market capitalization of $2.14 trillion, showing a 0.24% increase.

The last 24-hour trading volume increased by almost 33% to stand at 39.11 billion, signifying a greater market participation. The relevant ratio of volume to market cap 1.82%, indicates medium liquidity given the size of the asset. Its fully-diluted valuation i.e. the total market cap that could be achieved should all 21 million coins be minted is at a value of 2.26 trillion dollars. The total supply and circulating supply has been stable with the two values being close to 19.88 million BTC, and this shows proof of protocol of a fixed supply of Bitcoins.

The Realized Supply ratio is now approaching historically high levels prior to the past two rallies, including November 2024, when Bitcoin increased in value to $107,000 after starting offering at the value of $74,000. According to current data, the market is in a neutral stage, and there is no sign that it is being overstretched or underpriced.

Kraken Launches xStocks, Bringing 60 Tokenized U.S. Equities Onchain

Kraken has allowed Wall Street to trade on the blockchain. “xStocks” is its new 24-hour market that ...

INTO Collaborates with OnlyLayer to Boost Ethereum L2 Scaling

This latest collaboration between Intoverse and OnlyLayer denotes a significant step to redefine Lay...

ZENi Collaborates with SecondLive to Reshape Web3 Digital Creation

ZENi joins forces with SecondLive to elevate AI-driven Web3 creation by enabling immersive SocialFi,...

Adler Jr (@AxelAdlerJr)

Adler Jr (@AxelAdlerJr)